When I was in University, I was lucky to only have lectures 2 days a week, each lasting 3 hours long. That meant I was only in class 6 hours a week, and I had a ton of free time.

Take note that I drove for Grab for 6 months in University, during that time Uber had already left the market and Grab was the only big ride hailing firm here in Singapore.

I also drove for Grab from graduation up till I found a job, for another 2 months. During that time, Go-Jek had come into the picture, but I am only talking about my experiences driving with Grab here today in this blog post.

I will be breaking down the post into a few different sections.

- Process to getting a PDVL

- Process to becoming a Grab Driver

- Car Options for PHV

- Fares

- Hours to Drive

- Petrol

- Incentives

- Pros

- Cons

1. Process To Getting A PDVL

I was lucky that in the time I was applying to be a PHV driver, Grab had this scheme called Grab Fast Track.

This meant that I did not pay any upfront costs for the PDVL course and Grab had subsidized it for me fully. As I am below 25 years old, I also did not have a Skills Future account. You can pay for your PDVL course from your Skills Future account.

Now, you have to apply for your PDVL course yourself from this link. You have to pay a total of $155.15 upfront to complete and pass the entire course before you can take your temporary PDVL slip to Grab and apply to be a driver.

The PDVL requires you to do a compulsory medical check-up and also have a minimum GCE N or O Level English Grade D7 and above, or WSQ Conversational English (Competency Level 3).

At the point in time I was taking the PDVL, i was required to do a 1-day (10 hours) course at the Singapore Taxi Academy at The Herencia. This was then followed with an exam exactly 7 days after which consists of 2 papers, similar to BTT and FTT.

Once you pass the 2 papers, you will be issued with a temporary PDVL slip which you can take to the Grab office and start to apply for your driver account. However, do take note that they will not issue you the temporary PDVL slip if your medical results are not in yet.

2. Process To Becoming A Grab Driver

So if you already have your PDVL, congratulations! You can now apply for your driver account.

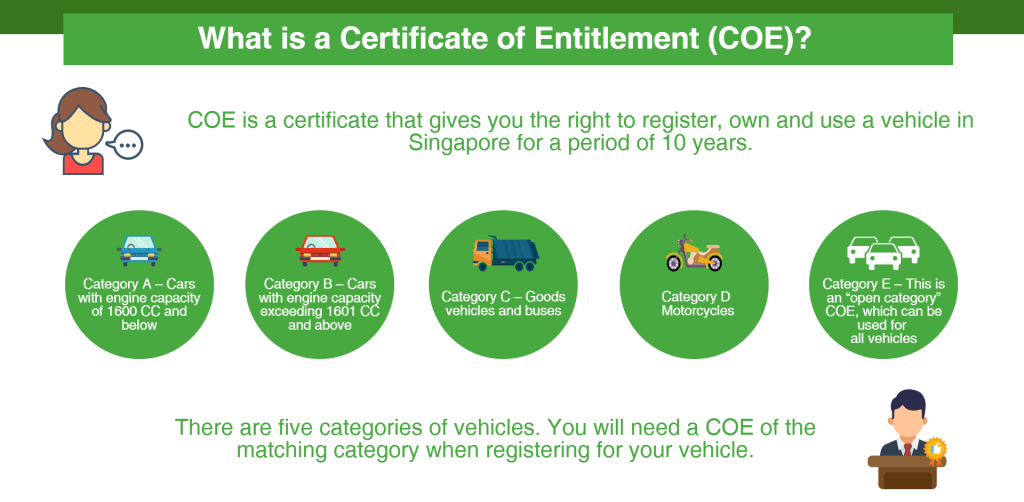

You will need to provide certain documents such as your personal information such as the basic NRIC, Driving License, Proof of Residence etc. and also your vehicle information such as Certificate of Insurance, Vehicle Log Card, Rental Agreement etc. to register as a driver.

For me, I had about a 1-day downtime. I collected my vehicle on a Monday morning from my rental company, and proceeded to activate my account at the Grab office the same afternoon. It took about 3 hours in total and I was able to leave by the evening. The account was only up and ready for use the next day (Tuesday).

Please ensure that you are free and not rushing off on the day you go to the Grab Office as there can be quite a queue. There is also a compulsory training that you have to undergo on the day itself. This includes a 30-minute video you have to watch and a simple MCQ quiz that you have to pass afterwards.

3. Car Options For PHV

There are many options out there in the market today of course. Just to name a few:

- Your Own Car

- Rental Car

- LTO (Lease To Own Schemes)

Personally, I drove with a rental car when I was in University for 6 months.

Cost For Each Car Option

Your Own Car.

- A cheap car’s depreciation: $6500-7500/year

- Z10 Commercial insurance: $1600-1800/year

- Vehicle Road tax: $600-800/year

Total Damage: $725 -850/month ($8700-10100 per year)

A rental car can cost you anywhere from $1200 per month to $1800 or even $2000 per month. I was driving at the rental rate of $435/week for a Honda Grace Hybrid.

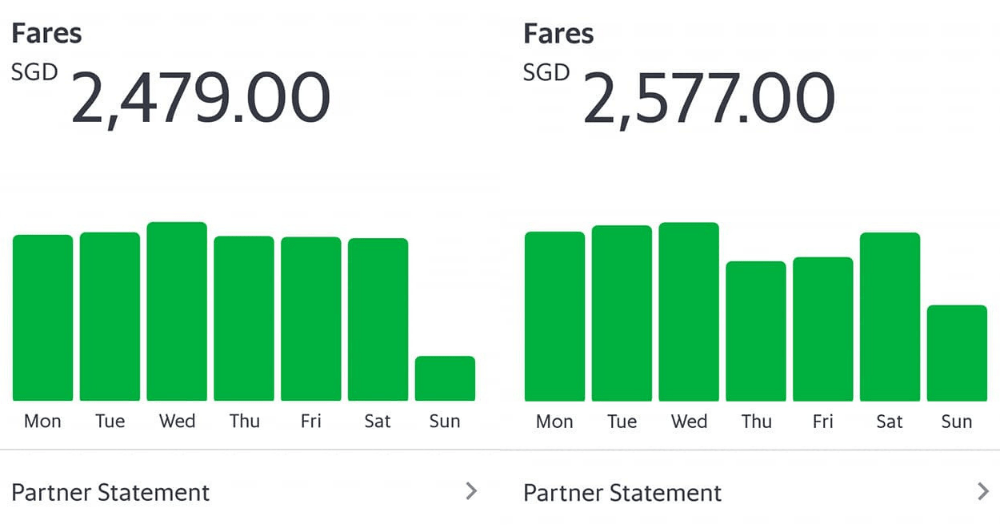

4. Fares

Now, to the point that everyone is interested in. How much exactly can we make?

Based off my experience, these are the average per hour fares:

- Weekday Peak Hours: $25-35/hour

- Weekday Non-Peak Hours: $20-25/hour

- Friday/Saturday Nights: $30-35/hour

- Weekends Other Hours: $25-30/hour

My best bet would be to normally aim for $20-30/hour in fares before commission.

Simply put, if you drive 8 hours a day, expect to make about $160-240 in fares before commission for that day.

5. Hours To Drive

Each driver has his or her own style of driving. Some prefer to drive in the night. Some prefer to drive in the day.

Some prefer to cherry-pick for good fares, while others prefer to accept all jobs that come in for the incentives.

Personally, i would drive from 6am-10am in the morning, and subsequently 4.30pm-8.30pm in the evening. That would make up about 8 hours of driving a day on weekdays.

For weekends, i would drive any hours that I’m free because the fares are generally quite similar throughout the day, except for Saturday nights where its slightly higher.

6. Petrol

There is one aspect we have yet to discuss – petrol.

On an average, I drive 30-50km an hour, including all picking-up distance, and also driving around to look for pings. Based on an average day at 40km per hour, I will be clocking about 320km on my car.

I was driving a Honda Grace Hybrid that has a fuel consumption of about 18-22km/L.

- Daily driven: 320km

- Fuel consumption: 18-22km/L

- Petrol used: 16-20 L

- Price of petrol: $2.42/L (at that point in time)

Total Price for Petrol: $38.70-$48.40/day before discount

After 20% PHV discount, we are looking at an average of $35/day for petrol.

7. Incentives

I know a lot of people are wondering, how about incentives?

Drivers ourselves will know that Grab has not been giving out good incentive returns ever since UBER left the market here in Singapore. Incentives were as good as non-existent in the time of my driving.

I was able to fight for about $50-100 worth of incentives if I wanted to. This generally meant I had to be hitting 50-100 trips a week, but I would have to keep my acceptance rates and cancellation rates good which I wasn’t able to do 90% of the time. Thus, there was barely any incentives left for me.

Incentives are of course higher for drivers who have great acceptance rates and low cancellation rates which is difficult for most part-time and new drivers because some fares can be quite low. Cancelling will mean bringing up our cancellation rates. Cherry picking drivers will definitely be called out.

Also, there are different tiers for every grab driver, more senior drivers who have been driving longer of course have a better incentive rate.

8. Pros

Of course, I enjoyed that short 6-months as a Grab driver. I was able to plan my time as and when I wanted and worked for no boss. I got up when I wanted and had the flexibility to do whatever I pleased whenever I wanted to.

I also had a vehicle to use whenever I needed, for my own personal errands or to go to school.

I was able to work harder and put in more hours on the road on weeks that I needed more money. I had a machine to make some money whenever I needed it, and could comfortably live day by day.

9. Cons

Sometimes, driving for long hours is not easy. Full concentration is required which means you have to be well-rested. Unlike working a desk bound job where you can doze off if you are sleepy, you can’t doze off on this job.

On the road, you are more at risk of accidents. Accidents are not only dangerous, but can be extremely expensive if you are involved in one. I was barely even profitable, who knows what would have happened if I got involved in any accidents?

I had to give up time, some events and also social opportunities because I could not just take the day off whenever I wanted. Everyday was a payable rental day and I had to make sure I had enough to pay off the car everyday. It was like a cat and mouse race.

Final Note

I hope this serves as a review, to all that may be out there wondering if they can make a quick buck or have their own vehicle just by driving a couple of hours a day on Grab.

All i can say is, long gone are the days of car ownership just by driving a few hours a week.

The only drivers who are making a decent living off driving for Grab are very likely full-time drivers that are driving at least 44-48 hours a week, at least.